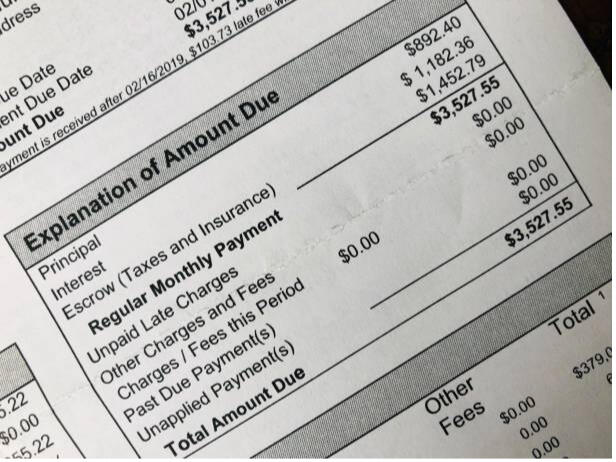

Most homeowners are overpaying on their mortgage— Let's fix that.

Our Mission

We cut the waste from your mortgage—PMI, overpaid insurance, missed exemptions—so you keep more of what’s yours. No hassle, no hidden fees, and best of all, no refinancing.

Our Promise

We promise to review your mortgage, insurance, and taxes with one goal in mind: trim what’s unnecessary and show you exactly how much you could be saving.

Our Guarantee

We guarantee to find you savings. If we can't show you actual annual savings, you don’t pay. Simple as that.

All it takes is a couple documents. We do the digging, you keep the savings. Let us show you how!

Questions: [email protected]

© Mortgage Trim. All rights reserved.

Based on public property records, your home does not show a Homestead Exemption on file.

If this is your primary residence, you could be paying more property tax than you should and may be eligible for prior-year credit/refund.What is a Homestead Exemption?

A homestead exemption is a tax benefit for your primary home that lowers the taxable value of your property, which can reduce your property taxes. It can also limit how much your appraised value can increase each year—generally up to 10%—unless you make major improvements or additions. To receive it, you must apply through your local appraisal district.Click below to have Mortgage Trim verify your status and confirm your eligibility.